Xpeng is a Chinese electric car manufacturer that has gained significant attention in the automotive industry since its founding in 2014.

In this blog post, we will talk about Xpeng Stock Price Predictions 2025, 2030, 2040, and 2050 to give an idea of where the company may be headed in the coming decades. To learn more about Xpeng’s future stock forecast, be sure to read the full blog post.

What is Xpeng?

Xpeng is a Chinese electric vehicle manufacturer that was founded in 2014. The company designs, manufactures, and sells electric cars, as well as provides related services to its customers.

Xpeng has become a major player in China’s rapidly growing electric vehicle market, offering a range of passenger and commercial vehicles including sedans, SUVs, and crossovers.

In addition to selling vehicles, Xpeng provides its customers access to charging stations and after-sales service. The company also has a growing network of research centers around the world focused on the development of intelligent electric vehicles.

Xpeng Stock Price Prediction 2023, 2024, 2025, 2030, 2040, 2050

| Year | Xpeng stock price forecast |

|---|---|

| 2023 | $14.34 |

| 2024 | $16.73 |

| 2025 | $19.95 |

| 2026 | $23.72 |

| 2027 | $27.43 |

| 2028 | $32.75 |

| 2029 | $37.97 |

| 2030 | $43.93 |

| 2040 | $160 |

| 2050 | Around $500 – $550 |

Xpeng Stock Price Prediction 2023

Xpeng’s stock price is expected to see significant growth in 2023. According to various market analysts, the company’s stock is predicted to reach $12.32 by the middle of the year and potentially rise to $14.34 by the end of the year.

This upward trend is expected to continue in the coming years as Xpeng continues to expand its product offerings and establish itself as a leader in the electric vehicle market.

| Year | Xpeng Mid-Year Forecast | Xpev Year-End Forecast |

|---|---|---|

| 2023 | $12.32 | $14.34 |

Xpeng Stock Price Prediction 2025

Based on current market trends and analysis of the company’s performance, it is estimated that the stock price of Xpeng may reach $17.25 by the middle of the year and possibly climb to $19.95 by the end of the year.

| Year | Xpeng Mid-Year Forecast | Xpev Year-End Forecast |

|---|---|---|

| 2025 | $17.25 | $19.95 |

Xpeng Stock Price Prediction 2030

Based on our current understanding of the market and Xpeng’s performance, we estimate that the stock price of Xpeng in mid-year 2030 could be around $40.05, with a possibility of rising to $43.93 by the end of the year.

This prediction takes into account various factors such as the company’s financial health, industry trends, and investor sentiment.

| Year | Xpev Mid-Year Forecast | Xpeng Year-End Forecast |

|---|---|---|

| 2030 | $40.05 | $43.93 |

Xpeng Stock Price Prediction 2040

Xpeng’s stock is expected to rise in 2040 due to government support, innovation, and growing global demand for electric vehicles. We predict the stock will be around $140 in mid-year and potentially reach $160 by the end of the year. If you want to check Xpeng Q3 results then click here.

| Year | Xpev Mid-Year Forecast | Xpeng Year-End Forecast |

|---|---|---|

| 2040 | Around $140 | Around $160 |

Xpeng Stock Price Prediction 2050

It is possible that the stock price could reach around $500-$550 due to factors such as strong financial performance, partnerships, increasing demand for electric vehicles, and a focus on innovation.

Additionally, Xpeng has formed partnerships and collaborations with other industry leaders, which could help the company expand its reach and further drive its growth.

| Year | Xpev Mid-Year Forecast | Xpeng Year-End Forecast |

|---|---|---|

| 2050 | Around $140 | Around $160 |

Which factors affect Xpeng Stock Price?

Xpeng’s stock price is influenced by various factors including the Chinese government’s support for electric vehicles, strong partnerships, increasing awareness of the environmental benefits of EVs, and advancements in technology and autonomous driving.

These factors have contributed to Xpeng’s success and market share in the EV industry in China and could continue to drive the company’s stock price in the future. Here are some points in detail:

Government Policies

The Chinese government has implemented policies to support the development and adoption of electric vehicles, which has provided opportunities for companies like Xpeng to thrive in the domestic market. As a result, Xpeng has become a leading player in China’s electric vehicle industry.

Partnerships

Xpeng has also established strong partnerships with other major automakers such as Volkswagen and BMW, which has helped to boost its reputation and increase its stock price. These partnerships have allowed Xpeng to access resources, technology, and expertise that have contributed to its success.

Sector Boom

There is growing awareness and concern about the negative impact of traditional fossil fuel-powered vehicles on the environment, which has led to an increase in interest in electric cars. This trend has helped to increase the demand for and value of Xpeng’s electric vehicles.

Technology

The technology used in electric vehicles is constantly improving, which means that newer models are able to offer more advanced features and capabilities.

This ongoing technological advancement is likely to continue to drive the demand and value of electric vehicles, including those produced by Xpeng.

Competitors

There are many new companies coming into the market and many Established brands are there in the market. So, for a company without any USP is difficult to grow.

Before just going to invest in one company you should also check its competitors’ price predictions. Here are some of the Companies which you can check out.

Autonomous driving

Autonomous driving technology, which allows vehicles to drive themselves to a certain extent, is also becoming more prevalent.

This technology has the potential to revolutionize the transportation industry and could further increase the demand and value of electric vehicles, including those produced by Xpeng.

Is Xpeng a Buy, Sell or Hold?

It is currently hard to determine whether Xpeng stock should be bought, sold, or held due to various unpredictable market factors and the potential for an upcoming recession.

It may be advisable for current owners of Xpeng stock to hold onto it rather than make hasty buy or sell decisions.

If you are considering investing in Xpeng, it may be best to wait for a favorable price and monitor market trends before making a move.

It is essential to carefully consider personal financial goals and risk tolerance before making any investment choices.

What other Analysts are Predicting about Xpeng’s Stock Price?

We have done our work. By using our advanced strategies we conclude that Xpeng is going to be bullish in the coming time. But don’t just see our words, Let’s see what other Experts are saying about Xpeng.

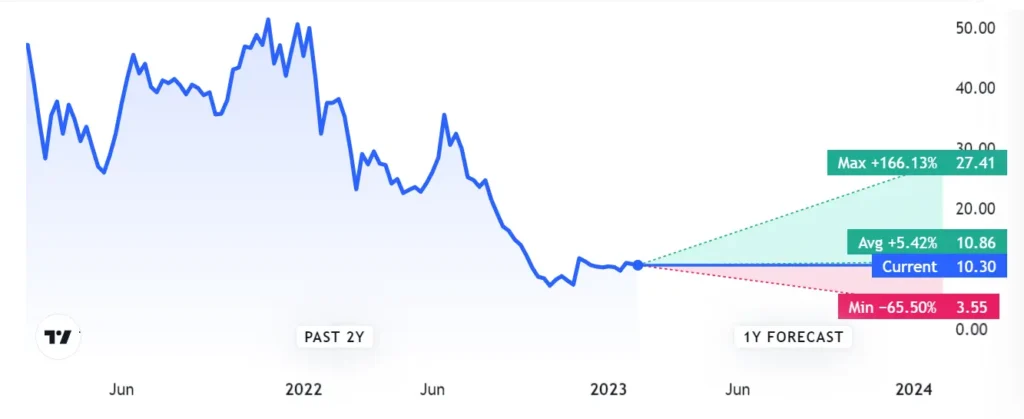

The above data is taken from Trading view. There it is clearly visible that the stock has the potential to blow up to 166% in one year. You know if your money will grow just 20% you will be a millionaire or a billionaire in 20 years. But here the concept got changed, You are getting more than a 150% Return.

If it is having the chance to blow up then it will also have some risk. If You want to get your money doubled then you also have to keep taking care of the risk.

Before Investing your money in any stock, always consider risk and then only do your research.

In the above chart, You can see all the support and resistance. According to the latest price, The Stock has broken all the resistance and gone up. Now there is no resistance near the price. So, there are huge chances of XPENG blowing up.

FAQ’s

What is the symbol of Xpeng stock?

The symbol for Xpeng on the NYSE is XPEV.

Is Xpeng a Profitable Company or a Loss-making?

Xpeng is experiencing losses, with a deficit of 2.38 billion Chinese Yuan.

Will Xpeng be the next Tesla?

It may be difficult for Xpeng to surpass Tesla in brand recognition and success in the electric vehicle industry at present, but the market is constantly evolving and new technologies are being developed all the time.

If Xpeng is able to innovate and bring new technologies to the market, it may be able to challenge Tesla’s position as a leader in the industry.

What will Xpeng be worth in 5 years?

It is Predicted that Xpeng stock could be worth around $30 in five years. There are many factors that could affect the value of the stock, such as the performance of the company, market conditions, and overall economic trends.

Conclusion

In conclusion, there are many factors that can impact the value of Xpeng stock. However, based on the company’s performance and market trends, it is possible that Xpeng stock could be worth around $30 in five years.

If you enjoyed reading this article and want to share your own Xpeng stock price predictions for 2025, 2030, 2040, and 2050 we encourage you to leave a comment below.

We would love to hear your thoughts and ideas.