Quantumscape has been making waves in the tech industry with its revolutionary approach to battery technology. But what does the future hold for Quantumscape’s stock price?

Our team of experts has crunched the numbers and come up with a forecast for Quantumscape’s stock price that you won’t want to miss.

Find out where we think Quantumscape’s stock is headed by reading the full article on Quantumscape stock price prediction.

What is Quantumscape?

Quantumscape is a publicly traded company with a focus on innovative battery technology. Founded in 2010, the company has developed a unique battery that offers improved performance compared to traditional lithium-ion cell.

With potential applications in automotive, consumer electronics, medical devices, and other industries, this technology has the potential to disrupt the way energy is stored and used.

As an investor, it may be worth considering the potential growth opportunities offered by Quantumscape’s cutting-edge technology.

Quantumscape Stock Price Prediction

QuantumScape Stock price forecast returns can disappoint you for 2-3 years but in long term, its compounding and QS’s returns will shock you. Here is our prediction list for the next few years.

| Year | Quantumscape Stock Price Forecast |

|---|---|

| 2023 | $5.70 |

| 2024 | $7.20 |

| 2025 | $9.04 |

| 2026 | $10.80 |

| 2027 | $13.40 |

| 2028 | $16.03 |

| 2029 | $18.56 |

| 2030 | $20.64 |

| 2040 | $80.56 |

| 2050 | Around $200 – $300 |

QuantumScape Stock Price Prediction 2025

Our stock forecast is that Quantumscape’s stock price will reach $9.04 in 2025. Quantumscape is a leader in battery technology, particularly in the electric vehicle (EV) industry.

The EV industry is growing quickly due to climate concerns and the demand for sustainable transportation options. Quantumscape’s technology is well-suited to capitalize on this trend and we believe the company’s stock price has significant growth potential.

| Year | QuantumScape Stock Price Forecast |

|---|---|

| 2025 | $9.04 |

You can also check Mullen stock price prediction 2025 – 2030, as it can give you a lot of huge returns in the future.

QS Stock Price Prediction 2030

According to our latest stock predictions, we expect QuantumScape’s average forecast is $20.64 in 2030, representing a growth and average return of around 3x from its current price.

This projection is based on a thorough analysis of the company’s financial performance, industry trends, and other relevant factors.

Several analysts and industry experts have also expressed bullish sentiments about QuantumScape’s future growth potential.

Many believe that the company’s innovative battery technology has the potential to disrupt multiple industries and drive significant value for shareholders.

| Year | QuantumScape Stock Price Prediction |

|---|---|

| 2030 | $20.64 |

QuantumScape Stock Price Target 2040

As an investor, it is important to consider the long-term potential of a company and its stock. With this in mind, our Quantumscape Stock price forecasts for 2040 is $80.64.

This represents a significant increase from the company’s current stock price and reflects our belief in the long-term growth potential of QuantumScape’s innovative battery technology.

The electric vehicle (EV) industry is rapidly expanding and is expected to play a major role in shaping the future of transportation.

QuantumScape’s technology is well-positioned to capitalize on this trend and could potentially drive significant value for shareholders as the world transitions to EVs.

| Year | QS Stock Price Prediction |

|---|---|

| 2040 | $80.64 |

QuantumScape Stock Price Prediction 2050

As a long-term investor, it is important to consider the potential growth of a company and its stock. Our QuantumScape stock forecast for 2050 is in the range of $200-$300.

This forecast is based on a comprehensive analysis of the company’s financial performance, industry trends, and other relevant factors.

QuantumScape, a leader in battery technology, is well-positioned to capitalize on the growing electric vehicle (EV) market and has the potential to disrupt multiple industries beyond the EV sector.

Also Read: Polestar Stock Price Forecast Nikola Stock Price Prediction

| Year | QS Stock Price Forecast |

|---|---|

| 2050 | $200 – $300 |

EV Sector analysis

The electric vehicle (EV) market is experiencing rapid growth, as evidenced by global EV sales of 5x between 2015 and 2022.

This surge in demand is due to a combination of factors, including the improved performance of EVs in terms of range, power, and charging speed, their relatively lower average price compared to other forms of transportation, and the environmental benefits they provide.

Governments around the world are also recognizing the value of EVs and are implementing measures to encourage their adoption, such as offering subsidies and supporting services infrastructure. As a result, the electric vehicle sector is expected to continue expanding in the coming years.

In recent weeks, investors have been selling off their shares of QuantumScape due to concerns about a potential recession and disappointing quarterly results.

As a result, the stock has fallen from a closing price of around $38 per share at the end of November 2021 to around $5 in January 2023. Here are a few reasons why QuantumScape’s stock price has declined:

- Recession Fears: Investors fear that turbulent economic times may signal bad news for electric vehicle stocks like QuantumScape.

- Poor Quarterly Results: The company reported disappointing financial results in its fourth-quarter earnings report, leading investors to pull back from this speculative long position.

- Concerns Over Valuation: At its current market capitalization of $13 billion, many analysts believe QuantumScape is overvalued given its limited track record and technology risks associated with battery production at scale.

- Short Selling: There has been a spike in short-selling activity on QuantumScape, with some investors betting that the stock will go down further as the company struggles to prove its technology will work at scale.

- Competition: QuantumScape faces stiff competition from established auto giants like Tesla, and some investors are concerned about their ability to compete in the long run.

Given these factors, it appears that there is a high level of uncertainty surrounding QuantumScape’s future. Investors should continue to monitor the stock closely in order to determine whether it is a worthwhile investment opportunity.

You can also watch the below video to know more!

Factors that Affect Quantumscape Corporation Stock Price

Quantumscape’s stock price can be influenced by a range of factors. Some of the key drivers include:

- Sector performance: Quantumscape operates in a specific sector, and the overall performance of this sector can impact the company’s stock price. If the sector is doing well, it may lead to an increase in Quantumscape’s stock price.

- New technology and production methods: Quantumscape is known for its innovative battery technologies. If the company introduces new technology or production methods that are well-received by the market, it could lead to an increase in the stock price.

- Macroeconomic conditions: The overall state of the economy can impact Quantumscape’s stock price. If there is economic growth, there may be increased demand for automotive batteries, which could lead to an increase in the company’s stock price.

- Research and development initiatives: Quantumscape is investing in R&D to expand its product offerings with advanced battery solutions. If these investments are successful, it could lead to higher returns for investors and an increase in the stock price.

- Production processes: The speed and efficiency of Quantumscape’s production processes can impact the stock price. If the company is able to bring its products to market quickly or increase supply faster than expected, it could lead to further increases in the stock price over time.

Is QuantumScape a Buy, Sell, or Hold?

If you are already holding QuantumScape stock in your portfolio, it may be a good idea to hold onto it or even consider buying more to average your position.

However, if you are considering purchasing QuantumScape stock for the first time, it is important to carefully evaluate whether it is a good investment for you. It may be helpful to perform technical analysis or do other research to get a better understanding of the stock’s short-term price movements.

While QuantumScape has the potential to be a strong long-term investment due to its innovative battery technology, it is important to keep in mind that the stock market can be volatile and the price of a stock can go down in the short term.

Therefore, it is always a good idea to do your own due diligence before making any investment decisions and trade.

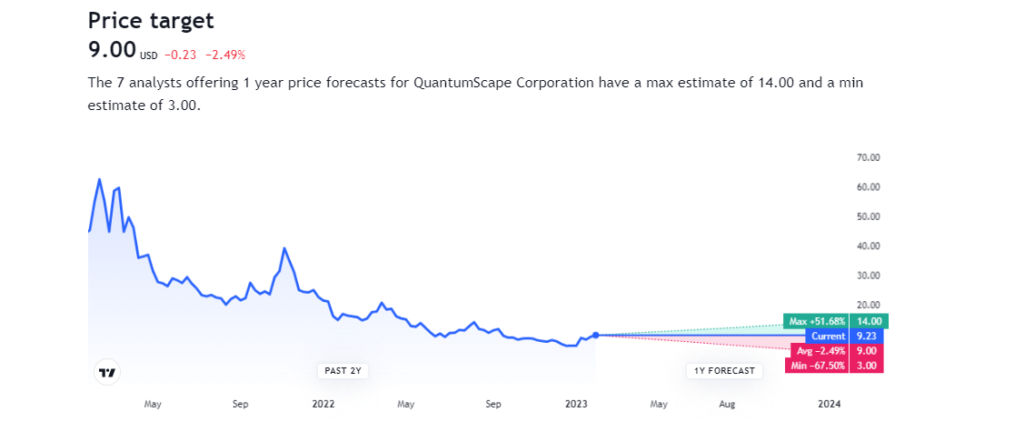

What other Analysts are thinking about QS Stock?

There are many other Analyst and Experts in the market who do their analysis and predict the market. Rather than just knowing the predictions or forecasts of only one person, You should also see other person perspectives.

Here are some Chart Analyses and predictions from other analysts

There are many chart patterns that show the bullishness or bearishness of a stock. In the Quantumscape Stock chart, Head and shoulder chart pattern is shown which means the stock can go up after breaking the levels as you can see in the above picture.

Here ChartingInsights analyzed that Quantumscape is a super bullish stock that you can add to your portfolio. They are super bullish on it because for the last 2 years, the stock was in a falling wedge but now it broke out and the target is approx $70 – $80 given by them.

FAQ’s

What is the future of QS Stock?

Some Analysts including us are bullish about Quantumscape Stock. At the end of Dec 2023, QS price can reach $7.20 and till Dec 2025 it can easily reach $10.80 which is pretty cool.

Does Tesla Use QuantumScape?

Tesla is currently investigating solid-state technology as a potential technology for use in its electric vehicles. QuantumScape has already conducted extensive research in this area and has successfully developed this new technology.

In order to accelerate its own progress in this field, Tesla is leveraging QuantumScape’s data, technology, and top-notch batteries.

Does QuantumScape pay dividends?

At this time, QuantumScape is not distributing dividends to shareholders. Instead, it is allocating its resources towards R&D, increasing production capacity, and forming commercial partnerships.

Will Quantumscape Stock Recover?

There is a high probability that QS stock gets recovered because QS is developing Solid-State batteries which will be the future of the EV sector. It started getting down just some time ago.

Conclusion

All things have been considered, it is evident that in the short term Quantumscape stock price can drop but in the long term, it will be bullish. The company has a lot of potentials and is working on something that can change the future as we know it.

That being said, there are always risks involved when investing in stocks and one should not invest more than they are willing to lose.

We hope this article was helpful in giving you a better understanding of Quantumscape stock and our predictions for its future prices. As always, feel free to leave us a comment down below if you have any questions or feedback!