Polestar is a relatively new player in the automotive industry, having only been around for just over two years. Despite its youth, the company has quickly made a name for itself as an innovative and exciting car manufacturer.

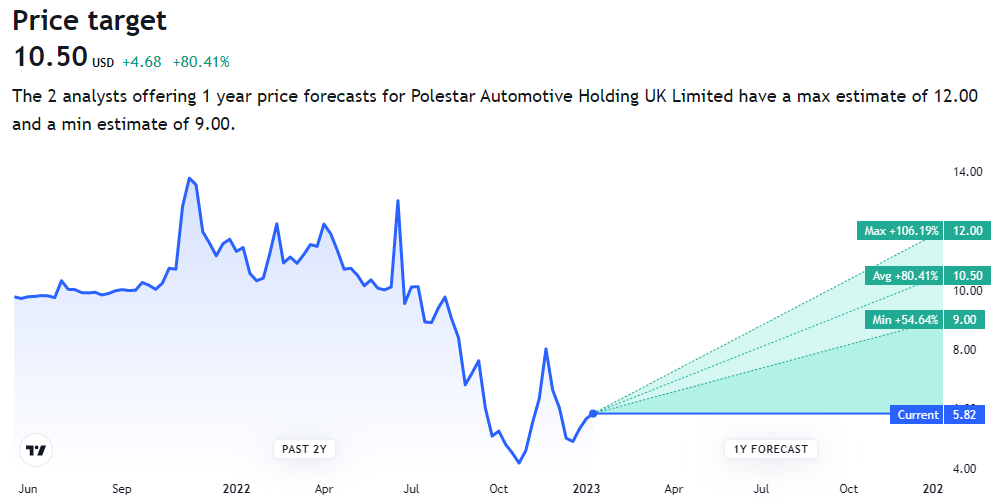

As a result, many investors are interested in Polestar Stock Price Prediction 2023, 2025, 2030, 2040, 2050. In this blog post, we will take a deep dive into the factors that could influence the stock price of Polestar, as well as provide our own predictions for the company’s future performance.

What is Polestar?

Polestar is a cutting-edge electric vehicle (EV) brand that was founded in 2017 by Volvo Car Group and Geely Holding Group. It was established as a separate brand from Volvo in order to concentrate more on the design, engineering, and production of EVs.

Today, Polestar is renowned for its expertise in the EV industry and offers a range of models including the Polestar 2, Polestar 1, Polestar Precept, and Polestar Performance.

Polestar, a relatively new player in the automotive industry, has gained significant attention from investors who are interested in predicting its stock price. The company has quickly established itself as a major player in the electric vehicle market

Polestar Stock Price Prediction 2025, 2030, 2040, 2050

| Year | Price Prediction |

| 2023 | $2.04 |

| 2024 | $2.63 |

| 2025 | $3.13 |

| 2026 | $3.94 |

| 2027 | $5.11 |

| 2028 | $6.38 |

| 2029 | $7.24 |

| 2030 | $9.14 |

| 2040 | $34.63 |

| 2050 | Around $150 |

Polestar Stock Price Prediction 2025

It is predicted that Polestar’s stock price will experience significant growth in the next five years, with estimates ranging from $3.13 – $3.21 by 2025.

The expected increase is due to the growing demand for electric vehicles and Polestar’s ability to meet this demand through its advanced manufacturing capabilities, along with the support of its parent company, Volvo.

This prediction of a $3.13 growth in Polestar’s stock price over the next five years is based on the current market trends and industry insights.

| Year | Polestar Stock Price Prediction |

|---|---|

| 2025 | $3.13 |

Polestar Stock Price Prediction for 2030

According to analysts, it is believed that the stock price of Polestar could experience significant growth in the next decade, potentially doubling or tripling in value.

Some experts predict that by 2030, the stock price of Polestar could reach a range of $9.00 – $9.14 per share, due to the anticipated high demand for electric vehicles and the company’s strong position in the market.

| Year | Polestar Stock Price Prediction |

|---|---|

| 2030 | $9.14 |

Polestar Price Prediction 2040

Based on our comprehensive analysis, we are confident in forecasting that Polestar’s stock price has the potential to reach $34.00 by 2040.

This projection is supported by several favorable market indicators, including the rising demand for electric vehicles, Polestar’s competitive market position and impressive product line, and the increasing recognition of sustainable transportation options.

We believe that Polestar’s strong foundation and promising outlook make this price target attainable.

| Year | Polestar Stock Price Prediction |

|---|---|

| 2040 | $34.63 |

Also Read: Mullen stock price forecast

Polestar Price Prediction 2050

Polestar, a Swedish brand known for its production of electric and hybrid vehicles, could potentially see its stock price reach around $ 150 by 2050.

It is impossible to accurately predict the future stock price of any company, but it is worth considering the potential for growth in the electric vehicle sector.

Polestar, with its focus on eco-friendly options and strong industry presence, could potentially benefit from this trend. That being said, it is important to exercise caution when investing and to thoroughly research a company before committing any funds.

| Year | Polestar Stock Price Prediction |

|---|---|

| 2050 | Around $150 |

Why Polestar Stock is going down

Polestar’s stock price has been experiencing some ups and downs as of late. In the past few months, the electric vehicle manufacturer’s stock has undergone several sudden and significant declines, culminating in a 40% decrease in value between February and March 2021.

This has left investors wondering what is causing the stock to decline so rapidly. There could be a number of reasons for the drops, including increased competition from other electric vehicle companies, market instability, and production delays.

Here are four possible reasons behind Polestar’s recent drop in stock price:

- Increased Competition: As the EV market becomes more crowded and competitive, Polestar may be feeling the effects on its stock price. Companies such as Tesla, Nio, and GM are all vying for a share of the growing electric car industry, making it more difficult for Polestar to stay competitive in terms of pricing and innovation.

- Market Volatility: The stock market has seen significant volatility in 2021 due to investor concerns about inflation and rising interest rates. This can lead to sharp declines in stock prices as investors withdraw their funds from perceived risky or volatile investments.

- Production Delays: The pandemic and other challenges have disrupted Polestar’s plans to ramp up EV production, which may be causing investors to doubt the company’s ability to achieve its goals and leading them to sell off their shares.

- Valuation: Some investors may believe that Polestar is overvalued, trading at a price higher than its intrinsic value would suggest. This can prompt investors to sell off their shares and seek profits elsewhere, further driving down the stock price.

It’s worth noting that these are just a few of the possible factors at play, and investors should be aware of the risks and challenges associated with investing in a company like Polestar.

Also, Before investing in any stock you should also study stocks in the same sector. So, we have already prepared a detailed prediction and analysis about them you can go and check out them.

Quantumscape (QS) Stock Price Prediction 2025, 2030, 2040, 2050

Which factors affect Polestar Stock Price

There are several factors that can significantly impact the price of Polestar stock. These include the company’s financial performance, global economic conditions, government policies, investor sentiment, and market speculation.

All of these elements can influence the demand for, and therefore the value of, Polestar stock.

Company Performance

The financial health and stability of the company can have a significant impact on the stock price. If the company is performing well and has strong fundamentals, investors will be more likely to purchase the stock, driving the price up.

On the other hand, if the company is struggling financially or has a weak financial position, investors may be less likely to buy the stock, causing the price to drop.

Global Economic Conditions

The overall state of the global economy can also impact the stock price of Polestar. A strong and thriving economy can lead to increased confidence in the company and its stock, while a struggling economy may cause investors to become more cautious and less likely to invest in the company’s stock.

Government Policies

Government policies and regulations can have both positive and negative impacts on Polestar’s stock price. Favorable policies may attract more investment and increase the stock price, while unfavorable ones may deter investors and decrease the stock price.

Investor Sentiment

The sentiment of investors towards the company’s performance and future prospects can also influence the stock price. If investors are generally optimistic about the company’s future, this may lead to increased buying pressure and higher stock prices.

Market Trends

The overall direction of the market can also affect the stock price of Polestar. If the market is performing well and trending upward, it may boost the stock price of the company. On the other hand, if the market is struggling or trending downward, it may drag the stock price of the company down as well.

Is Polestar Buy, Sell or Hold?

If you already have Polestar stock in your portfolio, it may be a good idea to buy more and average your position. However, if you do not currently have Polestar stock in your portfolio, it’s important to do further analysis before making a decision to buy.

While the company has potential for growth, it’s also important to consider potential risks and challenges. If you do not think that Polestar is in danger of failing, it may be a good idea to hold onto the stock rather than selling it.

Ultimately, the decision to buy, sell, or hold will depend on your individual investment goals and risk tolerance.

What makes Polestar an investable company?

Polestar is a company that produces electric vehicles that are both cost-efficient and environmentally friendly, and it has a strong customer base and growth potential.

It utilizes innovative technology and materials and has a global presence with over 300 stores in 25 countries.

Overall, Polestar’s innovative technology, strong customer base, and long-term growth potential make it an attractive investment opportunity. Its commitment to sustainability and excellence make it a standout player in the electric vehicle market.

Bull View on Polestar

Polestar is a relatively new car manufacturer that has gained recognition for its innovative and high-quality products.

The Bull View of Polestar stock is favorable, with investors pointing to the company’s successful positioning as both an electric vehicle market leader and luxury brand leader with its premium EVs, including the Polestar 2 and 3 models.

This has allowed the company to appeal to both high-end and more affordable markets in the electric vehicle industry.

Bear View on Polestar

Polestar’s stock is not a good investment at the moment due to declining share prices and concerns about the company’s profitability and growth.

The company has struggled to meet sales targets and acquire new customers and has announced layoffs and restructuring efforts that may further impact the stock’s performance.

It is unlikely that the stock will have significant upward potential in the near future, so investors should be cautious.

FAQ

Will the Volvo Polestar 2 be a significant threat to the Tesla 3?

It is difficult to determine whether the Volvo Polestar 2 will pose a significant threat to the Tesla 3. While the Polestar 2 has some advantages, such as being more affordable and offering more exterior customization options, the Tesla 3 is expected to have better range and acceleration capabilities.

Is Polestar a Profitable Company or Loss-making?

Polestar is a profit-making company. Since its launch in 2019, the company has garnered strong market success and has seen an increase in sales across Europe and China.

Polestar’s current production includes two all-electric models – the Polestar 1 hybrid coupe and the Polestar 2 electric sedan. The company is also set to launch its third model, the Polestar 3 electric SUV, later this year.

Does Polestar give dividends?

Polestar does not distribute dividends to its shareholders. Instead, the company focuses on reinvesting its profits into research and development to maintain its production of high-quality electric vehicles at competitive prices.

Could Polestar be an equal rival to Tesla in the near future?

Polestar has the potential to become a strong rival to Tesla, as it has a focus on premium electric vehicles and has demonstrated strong performance.

If the company continues to improve its technology and designs, it may be able to compete with and potentially surpass Tesla in certain areas. While the two companies currently have different target markets and approaches, there is potential for competition between them as electric vehicles become more widely accepted.

What is the Dividend Yield of Polestar?

At this time of writing, Polestar does not pay any dividends.

What other Experts say about Polestar?

Conclusion

In conclusion, the future of Polestar’s stock price is a topic of interest for many investors. While predicting the stock price of any company can be challenging, analysts believe that Polestar has the potential for significant growth in the coming years.

According to various predictions, Polestar’s stock price could reach anywhere from $2.00 – $30.00 by 2025, 2030, 2040, and 2050, respectively.

This growth is expected to be driven by the increasing demand for electric vehicles, Polestar’s competitive market position, and the recognition of sustainable transportation options.

However, it is important to exercise caution when investing and to thoroughly research a company before committing any funds.

Thank you for reading this analysis of Polestar stock price prediction. If you found this information helpful, please share it with your friends and colleagues who may also be interested in learning more about this exciting company.