Are you an AI fan, investor, or trader looking to capitalize on the potential of C3.ai’s stock? Do you want to know Is the C3.ai stock future for 2023-2050, a better bet for making profits?

We’ll take a look at the current and future landscape surrounding C3.ai as we consider its upcoming performance and make predictions for its long-term outlook.

Understand where this company may be headed when it comes to stock price prediction over the next three decades and what 2025 holds for it in terms of profitability. Read on to know about C3.ai stock price prediction 2025 – 2050 and all things about C3.ai

About C3.ai

C3 AI is a leading provider of enterprise-scale artificial intelligence (AI) and analytics software. Founded in 2009 by entrepreneur Tom Siebel, the company is headquartered in Redwood City, California.

C3 AI went public on 9 December 2020, with its initial public offering (IPO) raising $651 million at a valuation of nearly $7.3 billion.

C3 AI’s software platform enables organizations to develop and deploy their own AI applications faster, with less risk, and at a lower cost than ever before.

C3 AI’s suite of products allows customers to build AI-powered digital transformation initiatives such as customer experience management, fraud detection and prevention, intelligent supply chain optimization, predictive analytics for healthcare, and more.

C3.Ai Stock price prediction 2024-2050

| Year | C3.ai Stock Prediction |

| 2023 | $42.21 |

| 2024 | $49.98 |

| 2025 | $60.47 |

| 2026 | $72 |

| 2027 | $86 |

| 2028 | $104 |

| 2029 | $126 |

| 2030 | $153 |

| 2040 | $782 |

| 2050 | Around $3753 |

C3 Ai Stock Price Prediction for 2024

Based on the current market trends and projections, C3.ai’s stock is expected to continue its upward trajectory in 2024.

Analysts have predicted a stock price of $49.9 for the year 2024, which is approximately 20% higher than at Stock price in July 2023.

This steady growth can be attributed to the company’s efforts in expanding its customer base and strengthening its presence in the AI market.

As C3.ai continues to develop new products and solutions, industry experts believe that the stock will reach even greater heights by 2024.

| Year | C3.ai Stock Forecast 2024 |

| 2024 | $49.9 |

C3 Ai Stock Price Prediction 2025

C3 AI’s stock price prediction for 2025 is expected to be around $60. This is due to the increasing demand for enterprise-scale Artificial Intelligence (AI) and analytics solutions by organizations across industries.

As C3.ai continues to expand its customer base and launch new products and services, industry experts believe that their stock price will continue to appreciate in the future.

| Year | C3 Ai Stock price prediction 2025 |

| 2025 | $60 |

C3 Ai Stock Forecast 2026

C3 AI’s stock price prediction for 2026 is projected to be between $72 and $78, as the company continues to develop new and innovative products to meet customer demand.

With a focus on marketing its solutions across multiple industries, C3 AI is well-positioned to capitalize on the explosive growth of the artificial intelligence, analytics and predictive analytics markets.

| Year | C3 Ai Stock Forecast 2026 |

| 2026 | $72 |

C3 Ai stock price target 2027

C3 AI’s stock price prediction for 2027 is expected to be around $86-$91, as the company continues to pioneer new developments in the Artificial Intelligence (AI) and analytics market.

As demand for AI-powered solutions continues to accelerate, C3.ai is poised to benefit from its leading position in the industry. The company is also expected to launch a range of new products in the coming years, which could further drive its stock price performance.

| Year | C3 Ai stock price forecast 2027 |

| 2027 | $86 |

C3 Ai Stock Prediction 2028

C3 AI’s stock price prediction for 2028 is projected to be around $104, due to the increasing demand for enterprise-scale Artificial Intelligence (AI) and analytics solutions.

As organizations across industries like Google and Microsoft continue to rely on C3.ai’s software platform, the stock price is expected to continue its growth trajectory.

| Year | Ai stock prediction 2028 |

| 2028 | $104 |

C3 Ai Stock Target for 2029

C3 AI’s stock price prediction for 2029 is projected to be around $126. This is due to the ever-increasing demand for AI and analytics solutions across industries, as well as C3.ai’s steady growth in market share.

With the company continuing to develop new products and services that make use of their cutting-edge technology, industry experts believe that it will be able to capitalize on the potential of the booming AI and analytics markets.

| Year | AI stock price forecast 2029 |

| 2029 | $126 |

C3 Ai Stock Prediction 2030

C3 AI’s stock price prediction for 2030 is projected to be around $150, as the artificial intelligence (AI) and analytics market continues to experience exponential growth.

C3 AI’s leading position in the industry, combined with its well-established customer base, gives it a strong advantage over competitors.

Also Read: Shopify Stock Forecast 2025

| Year | C3 Ai stock price forecast 2030 |

| 2030 | $150 |

C3 Ai Stock Price Prediction for 2040

C3 AI’s stock price prediction for 2040 is projected to be around $782. This is due to the company’s commitment to staying ahead of the competition in developing and deploying cutting-edge AI and analytics solutions.

C3.ai has established itself as one of the leading providers in this field, providing customers with powerful software platforms that enable them to develop their own AI applications faster, with less risk, and at a lower cost than ever before.

| Year | C3 Ai stock price forecast 2040 |

| 2040 | $782 |

C3 Ai Stock Price Forecast for 2050

C3 AI’s stock price prediction for 2050 is projected to be around $3800. This is largely due to the power of compounding returns, as C3 AI’s share price has seen steady growth since its initial public offering (IPO) in December 2020.

As the company continues to invest in new technologies and products, industry experts believe that its stock price will experience further compounded returns over the long term. This is why C3 AI’s stock is expected to continue its upward trajectory and reach even greater heights in the future.

| Year | Ai stock price Forecast 2050 |

| 2050 | $3800 |

C3.ai Financial Performance

In the last fiscal year, C3.ai, a company that specializes in AI software for businesses, saw some promising growth. They made a total of $266.8 million, which was a 5.6% increase from the year before.

A big chunk of this income, 86% to be exact, came from their subscription services. This part of their business grew by 11.4% compared to the previous year.

When it comes to profits, they made $180.5 million in gross profit according to GAAP (Generally Accepted Accounting Principles) rules. In simpler terms, this means they made a 68% profit on each dollar of their revenue.

If we look at non-GAAP (a different way of calculating), their gross profit was $205.2 million, or a 77% profit on each dollar.

However, C3 Ai’s financials were good but they reported a net loss per share of $(2.45) according to GAAP and $(0.42) according to non-GAAP. This means that if you held a share in the company, the value of your share would have gone down by these amounts.

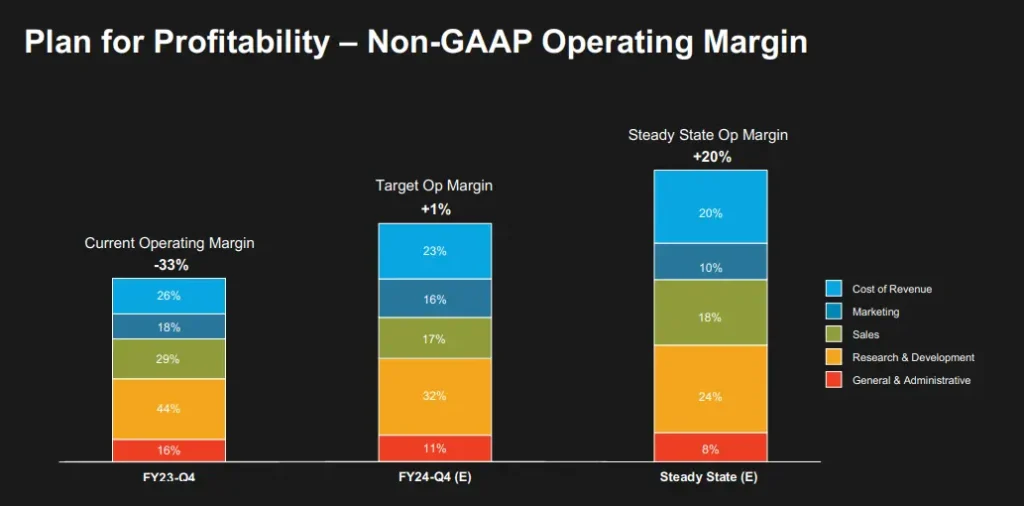

Despite this, C3.ai is hopeful about the future. They’re aiming to be profitable on a sustainable basis by the end of fiscal year 2024. Their performance shows that they’re a strong player in the fast-growing world of business AI applications.

If you want to know about C3.ai Financials in detail then you can go here.

Pros and Cons C3.ai

Pros

- Strong Partner Model: C3.ai knows how to play well with others. They closed 126 deals last year, and more than half of those were with partners. This shows they’re good at working together with other businesses, which could lead to more growth.

- Significant Growth with Major Cloud Providers: C3.ai is getting along really well with big cloud companies like Google Cloud and AWS. They’ve been finding more and more opportunities to work together, which could mean more money coming in.

- Making Waves in the Government: The U.S. Air Force has chosen C3 AI’s Predictive Maintenance Solution as their go-to system. This is a big win and could open doors to more opportunities in the government sector.

- Always Innovating: C3.ai isn’t just resting on its laurels. They’ve released a new product, C3 Generative AI, which shows they’re always looking to innovate and stay ahead of the game.

Cons

- Relying on Others: A lot of C3.ai’s deals are with partners. If anything changes in these partnerships, it could impact how well the company does.

- Changing Revenue Model: C3.ai is switching to a consumption-based revenue model. This could lead to more revenue down the line, but it’s also a big change and comes with its own risks.

FAQ’s

Conclusion

C3.ai is a technology company that has made some impressive strides in the artificial intelligence and analytics markets, with strong partnerships and a customer base to help it continue to grow over time.

With C3.ai stock price prediction for 2030 at $150 and 2040 at $782 due to compounding returns, C3 AI may be an interesting option for investors who want to get in on the ground floor of this cutting-edge industry.

However, investing comes with risks including lack of profitability, reliance on partners, and transition uncertainties associated with a consumption-based revenue model which should all be taken into consideration before making any investment decisions.